Investing in real estate is a great way to increase diversification in your passive income. It offers passive rental income and long-term returns, which can help you reach financial independence and retire early.

There are many ways that you can to invest in real estate, and here we discus fractional investment platforms, specifically Reinvest 24.

Reinvest24 is a real estate crowdfunding platform that was launched in 2018, offering fractional investments (also known as fractional ownership) in residential and commercial properties.

I have been investing in the platform now for a few years, and have invested in multiple successful real estate projects, so check out my Reinvest24 Review below.

What is Reinvest24 and How Does It Work?

- Reinvest24 Statistics

- How Does the Platform Work?

- Types of Loans Available & The Secondary Market

- Loan Protection

- Due Diligence

- My Returns

- Account Setup

- Fees

- My Platform Review

Affiliate disclaimer: Some of the links below may be affiliate links (disclosure). If you use these links to buy something we may earn a commission (which come at no additional cost to you). Thanks.

Platform Statistics

- 170+ projects funded

- Total projects funded: €28,990,000+

- Repaid back to investors €12,790,000+

- 0 defaulted projects – 68 projects repaid

- 14.8% total combined return yield + capital gain

- 6 markets

- 18,600+ investors (average portfolio €4.5k)

How Does It All Work?

Reinvest24 allows investors to purchase real estate investment projects and developments at a fraction of the cost. This creates options for diversifying within the real estate crowdfunding platform (with different properties), and among other investment classes (shares, peer-to-peer investments, litigation funding etc.). Read more about the benefits of fractional real estate investing.

The team selects each property after generating a risk profile, which includes identifying liquidity values, vacancies and estimates of price growth. From there, properties that return the most favourable criteria are selected for funding. The properties are listed on the website, and investors can choose which properties they would like to invest in. The minimum investment amount is 100 EUR.

Once the project is funded, investors earn a return on their money in two ways:

- monthly through rental dividends

- capital gains when shares are sold through the secondary market, or the project is finalised.

All earnings happen automatically, and are deposited into your account on a regular basis.

Majaka Example

Majaka 54 was the first development project on the platform, which involved purchasing a very old unmaintained building in a good location in Tallinn. The building was in much need of repairs, and required a lot of legal work to achieve compliance with the relevant authorities. This allowed the team to purchase the building way below cost, opening up possibilities for all investors to make money. The team were able to successfully repair and rebuild the building, and then sell off each of the apartments. Overall, all of the investments within the project were exited successfully, earning an average of 14.24% p.a.

The best part about it? All of the investors were kept informed on all progress through emails and also video updates. Here is the last update in the series that shows the finished product.

What Types of Loans Are Available?

The platform offers loans for both residential and commercial properties. These include rental apartments, development loans, office spaces, land plots, and commercial spaces, among other things. Interest rates on development loans can very from 13% to 15% p.a.

Other rental projects (i.e. not development loans) have two sources of income. Yield and capital growth. Yield may range from 6% to 8%, and capital growth can be as high as 7% p.a.

The Secondary Market

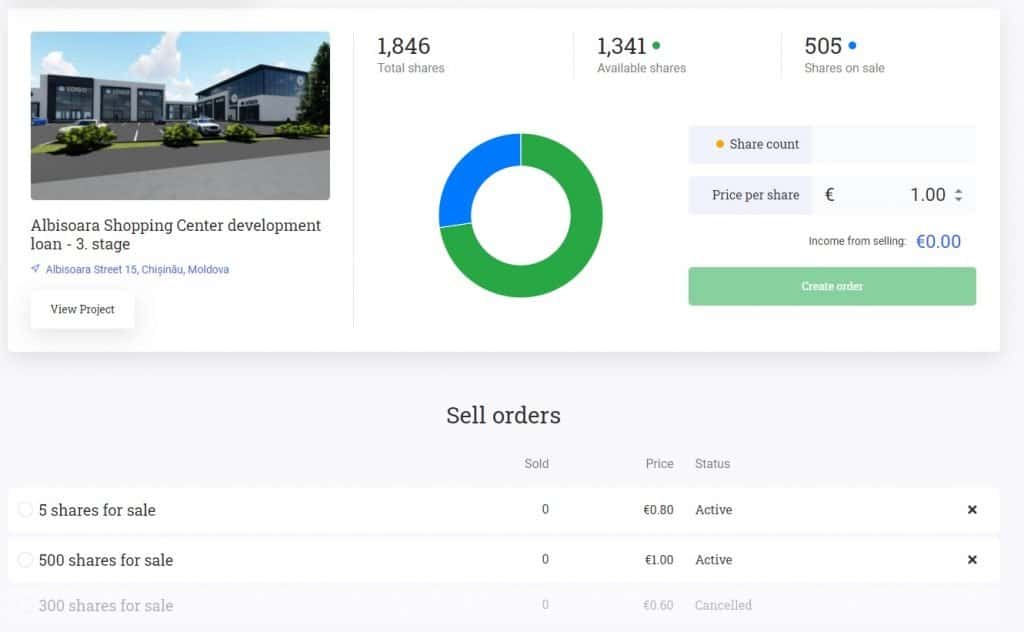

If you are unhappy with your investments, need to free up some cash, or are looking for additional investment opportunities, there is an option through Reinvest24 to be able to sell your shares before the property has been exited.

To do this, you can utilise the recently introduced secondary market. As soon as another investor purchases your listed shares, you receive your money instantly. More information about the secondary market can be found on in the platforms blog post here.

Buying on the Reinvest24 Secondary Market

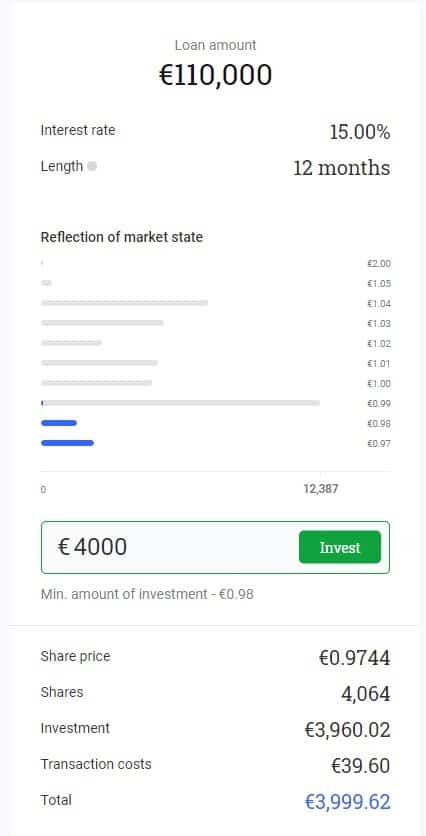

When you go into a property, there will be a little section under “Reflection of Market State”, which will show you the current offers available. These are the shares that other members of the platform are trying to sell. In the example below, you can see that the share price ranges from €0.97, to €2.00.

The shares will always be bought from the bottom up. So as you enter the value you are willing to purchase, the corresponding prices will light up.

In the example (above) of buying shares on the secondary market, you can see that €4,000 in this particular property will correspond of share packets of €0.97, €0.98, and €0.99, overall bringing my average share price to €0.9744. There are no transaction fees for buyers on the secondary market.

Register Today

If you like what you’ve seen so far, feel free to head on over to Reinvest24 and register an account.

There are no costs associated with opening an account.

Selling on the Reinvest24 Secondary Market

To sell your shares, you need to head to the Investment section near your profile. From there, you will be able to select your investment and choose how much you would like to sell. You are able to make multiple orders, and only sell partial amounts. There is no fee for selling any shares of properties.

Additionally there is a 1% transaction fee when selling an investment through the secondary market (1% for sellers and 0% for buyers).

How is your Real Estate Investment Protected?

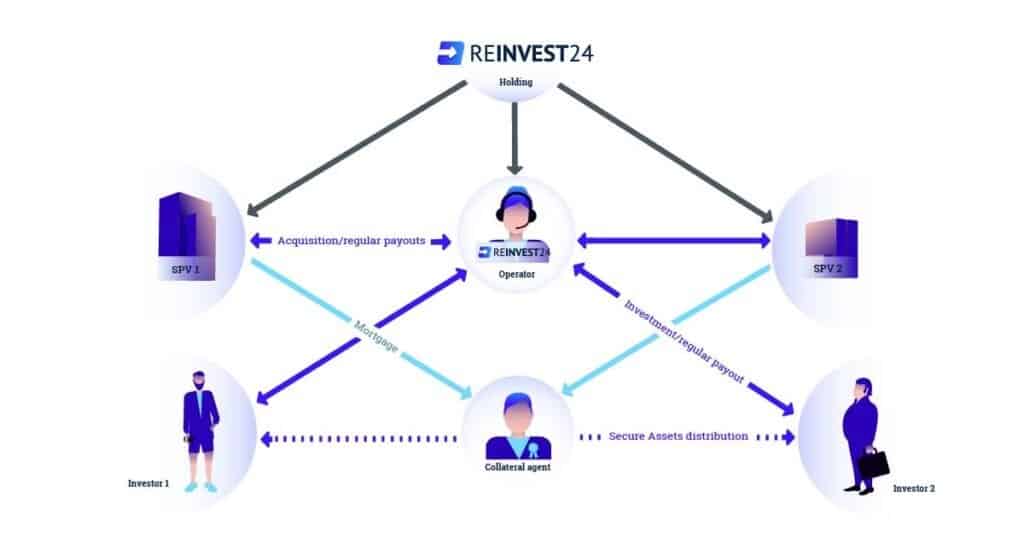

Investments through the platform are secured by various types of collateral. Once the investment has been fully funded, it becomes a part of a Special Purpose Vehicle (SPV). The SPV is a legal entity that manages the finances.

Development loans and some of the rental properties offer a 1st rank mortgage as collateral. Additionally, these loans will have a loan to value ratio of ~50% (can vary – check each project individually). Some projects that lease out office or other space don’t offer collateral, however these will have long term (i.e. 8 year) rental contracts in place.

The CEO, Tanel Orro, was also to create a video explaining how the platform works, and how your investments are kept safe.

Due Diligence

There are many things to like about the platform, that bode well with the platform being of sound nature. Some of these things include:

- Good communication, this is shown with the various video updates, the quarterly reports, and the regular emails.

- Knowing the team. The team do not hide. You can easily find and communicate with members of the team. Additionally the team all have backgrounds that compliment the product. You get to see and regularly hear from the CEO, Tanel Orro, who is the main actor in all of the update videos.

- Manageable projects. There have only been a few projects at a time, implying that the platform are taking care in selecting the projects, and are not taking on more than they can process.

- One bank account. The platform has kept the same bank account details, in the country that they operate in. The bank used is Swedbank, which is a licensed credit institution in Estonia.

- Transparency. Properties are kept separate through a SPV. This provides some transparency and keeps each investment separate. Additionally the management have made videos as to how your investments are safe.

As with any platform, there are always investment risks that you should be aware of.

Note: Before investing in this platform, or any other investment platform, it is important to undertake your own due diligence about the product. The due diligence that I have conducted here only looks at some aspects of the investment/platform. By no means does this article constitute a full due diligence on the investment mentioned. This article that I have written in no way forces you to invest.

Communication

The platform has very good communication practices with their investors. There are regular updates on their investment projects through their YouTube channel, as well as through email. There is also a lot of great content available through their blog, which goes beyond individual projects, discussing things such as the outlook on real estate markets in the Baltic region, how investments are chosen, and general financial investing tips.

Additionally they release question and answer sessions based on their most asked questions.

My Reinvest24 Returns

I was lucky enough to find the platform a few years, and invest in some of the early projects, such as the Majaka example below. As can be seen, I have received just under 15% p.a.

Account Setup

Account setup is fairly straight forward. You just have to enter you name, an email and a password and then you have been registered. Check out more details in the video below.

To create an account (and use the website), you will need to be a natural person >18, whose active legal capacity is not restricted.

Once you are logged in, you will need to go through the identification process. This involves proving who you are, to aid in the fight against money laundering.

Reinvest24 Fees

The platform charges a “success fee” (previously an “entry fee”) of 1% which is taken from the principal when a project has been exited.

The fee commenced from 22 November 2021, so any projects launched on the primary market before that date with have the previous entry fee (1% at the start of the investment).

Secondary market fees will also change, so after 18 November 2022, it will be the seller who has to pay 1% instead of the buyer.

ReInvest24 also charge up to 10% from rental revenue generated by the properties to cover various property management related expenses.

My Reinvest24 Review

As can be seen from my returns, Reinvest24 has been the highest paying real estate investment platform that I invest in. I am currently very happy with the platform and the investments that are on offer. I will state here that as I don’t personally want any exposure to development loans, I generally opt for the commercial property and business loans instead. That way I’m investing in something that already exists, and usually produces some form of current yield.

Drilling down into the specifics that I like about the platform. The “goods”:

- Can allow investors to access real estate investments through fractional portions. This saves dealing with legalities, mortgages and tenants. It also means that the financial hurdle to get into real estate is much lower.

- The platform offers quarterly investment overviews (example here), videos of the current progress, and insider updates on various projects.

- The secondary market allows investors to cash out of their loans.

- Documentation such as appraisal reports are readily available.

- The team cares about the projects, the loans available, and the investors.

- Is Reinvest24 Safe? Reinvest24 trustpilot comes up with 87% 5 star reviews (out of 100 reviewers).

With every platform you have to find something wrong don’t you? well here are my “bads”:

- There are fees associated with investing. However, the fees are low, transparent and necessary to make the platform work. Maybe I should be thankful that they are not hidden and taken out of the funding at the end?

- The platform hasn’t been around for very long, or experienced downturns like the COVID crisis. Usually a platform that has been around for 5-10 years is considered more safe than one that has only been around for 2. Additionally, new European crowdlending policies will come into play soon, so it will be interesting if anything needs to change.

If you like Reinvest24, I would also like to direct you to my Mintos review.

Reinvest24 Alternatives

If you are interested in real estate crowdfunding platforms, then you could also have a look at other lending platforms such as bulk estate, EvoEstate, Estateguru and Crowd Estate. When investigating each of these, ensure you do you proper due diligence, including things such as a platforms track record, and whether the investments are supported if they were to collapse (for example, are they mortgage backed loans?).

I hope you found some value in my Reinvest24 review, and I encourage you to check out my other p2p lending platform articles, leave a comment below or send me an email.

This was just one of many investing ideas that we have for you. If you want to find out other ways to invest, check out our list of additional investment ideas.