What Is Mintos?

This Mintos crowdfunding review is going to explain everything there is to know (hopefully) about the P2P lending investment platform Mintos. The investing platform provides a connection between people requiring financing (through lending companies) and investors.

Investors can be attracted to such loans as they provide a much higher than interest compared to a bank account, and it also offers a different asset class compared to the share market or real estate. Mintos currently offers various investments with returns averaging just above 10%.

Affiliate disclaimer: Some of the links below may be affiliate links (disclosure). If you use these links to buy something we may earn a commission (which come at no additional cost to you). Thanks.

Please note: Before investing in anything do your own due diligence and research. Nothing in this article is financial advice. Just one man trying to share his working and investing experiences!

About Mintos

Mintos (www.mintos.com) launched in 2015, and classes itself as a global online marketplace for loans. At the time of writing, Mintos facilitates 70 lending companies (previously loan originators) that operate in 34 countries. These countries include United Kingdom, Poland, Armenia, Sweden, Czech Republic, Latvia, Georgia, Colombia, Lithuania, Estonia, Bulgaria, Denmark, Finland, Spain, Russia Federation, Romania, and Botswana among others.

The platform also allows cross-boarder investments in multiple currencies including, among others: US Dollar, Euro, British pound, Swedish krona, Danish krone, Russian ruble, Georgia lari. Mintos also offers a currency exchange (for a fee) within the platform. These fees save you from having to have multiple bank accounts in multiple currencies. However, you may be able to integrate a TransferWise account into this as well.

So far, the average net annual return for investors on the Mintos platform is about 10.5, with more than 440,000 investors registered.

Mintos also has a secondary market, where people can buy or sell their part in a loan for a discount or a premium, allowing you to achieve an even higher return.

Mintos Statistics

- Mintos Marketplace AS, the

Joint-stock company was founded in Latvia in June 2015 - Mintos obtains European investment firm license in 2021

- The Mintos investment base has 509,000+ investors from 62 countries

- The yearly average return to investors stands at ~12.5%

- Over €8,700,000,000 has been invested in loans over the platform

Expected Returns from a Mintos P2P Investment Account

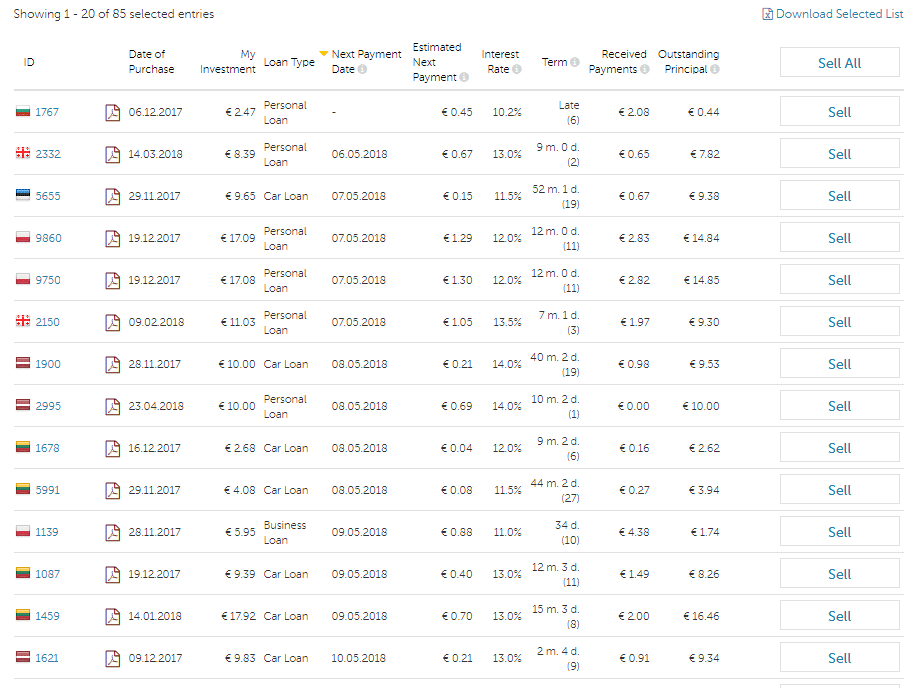

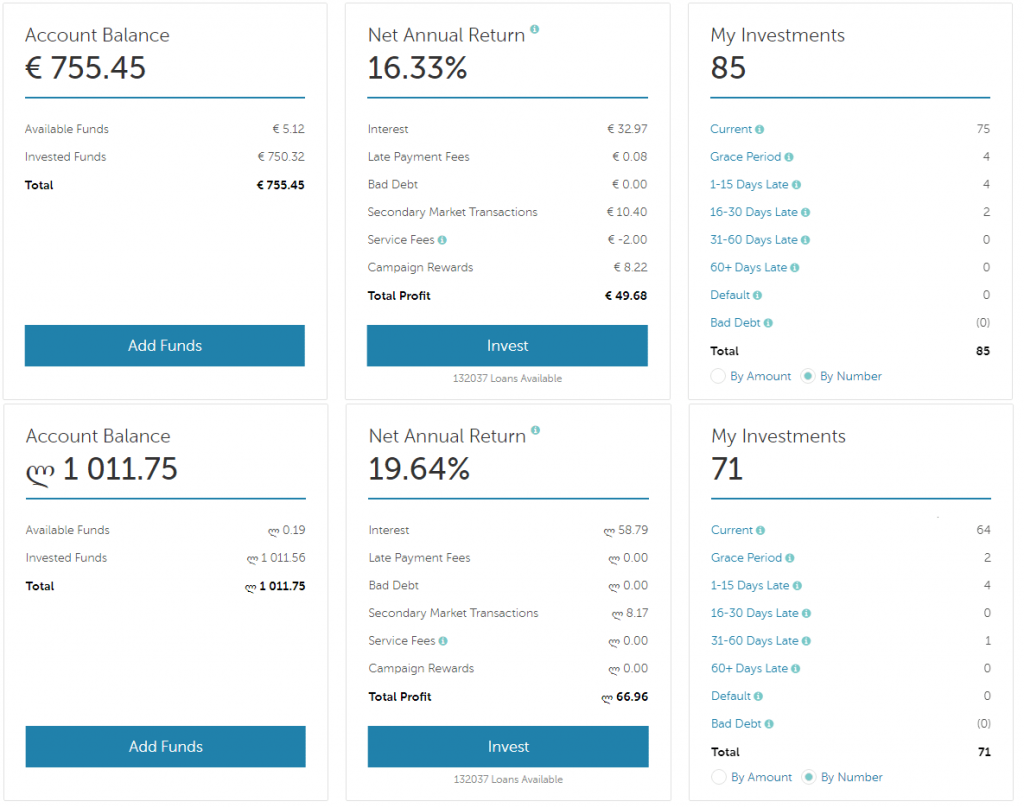

I have been investing in Mintos for a couple of months now, and you can see from my investment summary below the types of diversification, and types of regular payments you can get.

I have been careful with only using an amount that I was happy loosing. From the below picture, you can see that I have earnt an average of 16.3% so far investing in Euro p2p loans, and have earnt over 19% from investing in Georgian Lari (GEL) p2p loans.

As you can see from the picture below I have created diversification by spreading out my loans into 70 or more different investments per currency. If you have a loan that reaches 60 days without receiving a payment, you will get your money returned to you with the buyback obligation supplied by the lending company. (As I always choose to invest loans that contain a buyback structure).

It is important to do your own due diligence. In the past, one of the lending companies, Eurocent, ran into problems. A Temporary Judicial Supervisor was appointed to verify the financial standing of the company and help with debt restructuring. More can be found on the Mintos website here.

My Mintos Returns

It’s easy to be sucked into the “standard-expected-returns” that the main webpage shows, so I have shown you what my monthly returns actually look like. I have invested in Mintos since November 2017, and I am very happy with the results so far.

As can be seen in the graphs, the returns have been fairly consistent each month. For a while my returns work out to be approximately 12.5% per year. However, during the pandemic (2020-ish) I have chosen to keep money in the platform and uninvested. This means that the returns for these times will be very different from the initial returns I was getting.

You can find more of my monthly returns through my other crowdlending platforms, and stock market investments here.

I use Manual investing (i.e. active management) to manage my account, as I like to choose high quality loans myself (compared to passive management where the loans are chosen for me).

I believe that by looking for very specific loans, you can maximise your reinvestment and reduce any chance of “default” (although I make sure that I reinvest using buyback obligations).

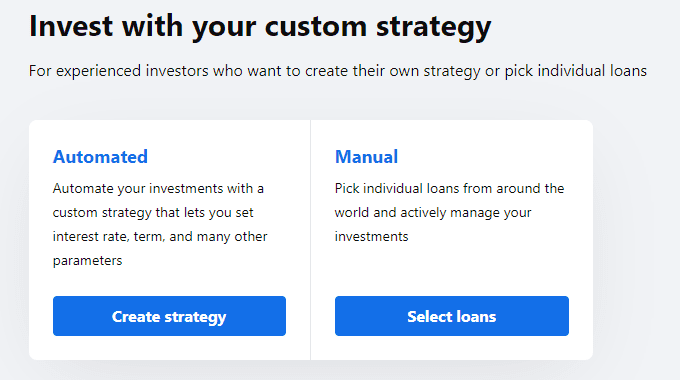

Manual Investments vs Automated Strategies

There are 2 ways of re-investing your earnings on the Mintos platform. One is through active management, and the other is through passive. Let me describe each of these in a bit more detail:

- Custom Manual Investments (Active management) of your Mintos P2P account involves logging into your account every couple of days to reinvest money into loans of your choosing.

- Custom Automated Strategies (Passive management) of your Mintos P2P account involves you using the re-investment feature on your account. The reinvestment feature can automatically reinvest payments received payments from a loan, according to reinvestment settings that you select.

Manual Investments | Automated Strategies |

You can very specifically select loans loans that have been proven to be paid on time. | You don’t get to select which loans you invest in. Some may have not received money, others may have been paid late. |

You have to long in weekly (or more often) to see what’s available. | You don’t have to log in every week |

Selecting loans can be time consuming | You don’t have to sort through thousands of loans |

Can result in a very undiversified portfolio | A balanced portfolio can be generated automatically |

Which re-investment setting in Mintos is right for me?

Let me ask you a question – how much time do you have, and do you care about your investment returns?

Automated strategies can be a good time-saver, but could invest in loans that you are not happy with. Manual investment is good to select loans that have a higher chance of being paid back, but take more time to manage.

I use manual investment to re-invest my money on Mintos as I want to make sure that I get paid constantly and on time.

What Are Custom Manual Investments?

Custom Manual Investing is the process of selecting specific loans based on various criteria through the primary or secondary market.

Filtering Custom Manual Investment Options

When you log into Mintos you can see pages and pages of loans that need to be filled. When I look just now, I can see that there are 90,000+ loans in the primary market and another 90,000+ in the secondary. That is way too many to filter through each time you want to reinvest.

Let’s take a look at ways of ways of reducing the list using the filters. Here is a short explanation on each of the filters:

- Currency – lets you see loans based on the different currencies that Mintos has on offer. You can only invest in the currencies that you have in your wallet.

- Loan Type – lets you select which type of loans you would like to invest in (i.e. Agricultural Loans, Business Loans, Car Loans, Invoice Financing, Mortgage Loan, Pawnbroking Loan, Personal Loan or Short-Term Loan).

- Country – lets you select which country you would like to invest in.

- Lending Company (previously Loan Originator) – lets you select loans from specific companies.

- Mintos Risk Score – a rating of 1-10 that has been provided by Mintos.

- Lending Company Status – selecting whether the company is current in repayments, of if they have been suspended, or defaulted.

- Buyback Obligation– lets you select if you want to only see loans with a buyback obligation. Buyback obligations are issued by the loan originator, and confirm that the lending company will repurchase the loan if a payment has not been received within 60 days. The loan will be purchased automatically at the nominal value of outstanding principal, plus accrued interest.

- Schedule Extension – whether the borrower has opted to extend the repayment schedule.

- Borrower APR – (effective APR) unified measure among all lending companies calculated on what it costs the borrower (principal, interest and fees) per loan

- Status – lets you filter loans based on whether the loan payments are on time or late. Options include Current (on-time), Grace Period (not late), 1-15 days late, 16-30 days late, 31-60 days late, and 60+ days late.

- Pending Payments / In Recovery – whether loans are currently in recovery.

- Investment Structure – lets you choose between loans with an direct or indirect structure. This filter only comes into play if the lending company was to go bankrupt. Most of the time investments will be made through the direct structure (i.e. assigning loans to investors), implying that if a lending company was to go bankrupt, you could claim against the borrower. An indirect investment means that you would have to claim against the company.

- Amortization Method – lets you select how amortization is paid. Amortization is a way of spreading out the loan into monthly payments. Mintos lets you select loans based on full amortization (paid off in monthly instalments), Partial (paid off in big instalments near the end of the loan period), interest-only or bullet (all interest is paid at the end period).

- Issue Date – when the loan was issued to the borrower.

- Listing Date – when the loan was listed on Mintos.

*Issue date is separate to listing date, as the initial loan agreement issued by the lending company may have started months before listing on the Mintos platform. - Amount Available for Investment – lets you enter an amount that is available for investment.

- Term – the term of the loan, i.e. how long to pay back the loan.

- Initial LTV – The initial Loan-to-Value ratio when the loan was first initiated. Represents the percentage of the loan against the underlying asset the borrower attached to the loan.

- LTV – Loan-to-Value ratio. The percentage of the loan against to the underlying asset the borrower attached to the loan.

- Loan ID – Lets you search for a specific Loan using the loans ID-tag.

- My Investments – Lets you toggle whether you see your investments show up in the list or not. Mentos will always indicate if you have.

Mintos Risk Score

The Mintos Risk score is an evaluation measure provided by Mintos that calculates the risk related to a loan company. The score is determined by 4 measures, including loan portfolio performance, loan servicer efficiency, buyback strength and cooperation structure.

All of the previous risk score updates can be found here.

Finding High Interest Loans on Mintos

have to admit, when I first wrote this article I was investing in loans through the Georgian Lari (GEL) as they were paying out over 18% (as you will see in my pictures further down). I do not live in Georgia, nor do I have any family or residence there.

My main goal was the juicy 18% return that was being offered. Unfortunately, since then, GEL loans have dropped their return. However, other loans through Russian Ruble (RUB) and Kazakhstani Tenge (KZT) still pay-out over 18% p.a.

However, beware, investing for high returns in countries like Russia and Kazakhstan is not for the feint hearted. In this case higher interest does equal higher risk. A pay-out of over 18% is definitely high risk.

When choosing loans to reinvest in, you must think like a bank (as you are the bank in these transactions). Unfortunately, we don’t have the same information as what a bank would, at least not in the same detail, however, similar principles still apply.

As the loan provider, you want to maximize your chance of receiving timely investment returns.

Here, I will show you what I look for when selecting loans:

Market Settings

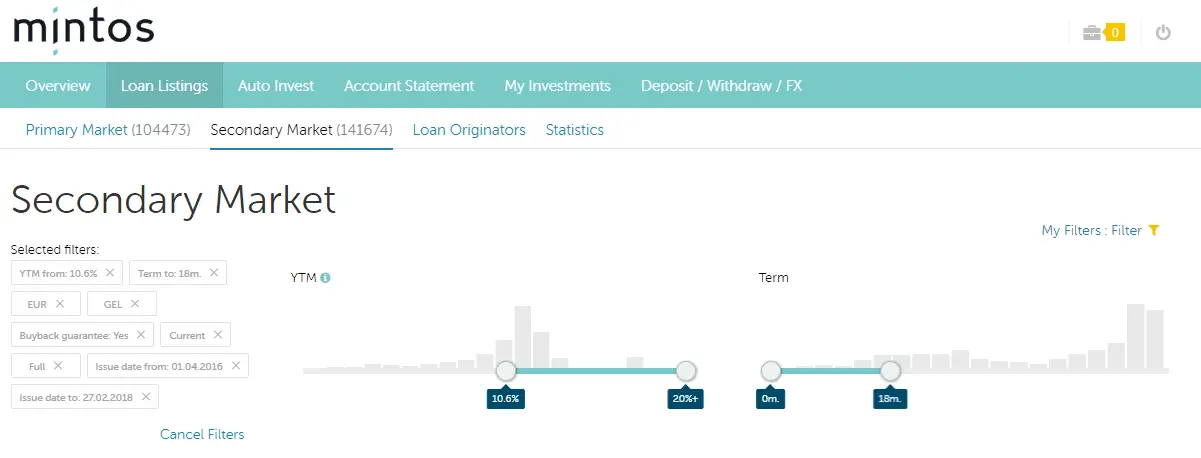

It is important to look at the Secondary Market and the Primary Market to get an understanding of the loans available. I look at the Secondary Market first to see if there are discounted loans that are not available in the Primary Market.

Buyback Obligation

Selecting loans that have a Buyback Obligation is extremely important unless you are willing to lose all your investments. The buyback obligation means that the lending company will pay back your investment if the borrower was to default (go 60 days without payment). You won’t get any interest for that period, but more importantly, you won’t lose your initial investment. However, be aware. If the lending company was to go bankrupt, the buyback obligation is counted as invalid, and you won’t get your money back. Therefore, it is important to diversify your loans with multiple lending companies.

Mintos Amortization

I select loans that have full amortization as I believe this is much easier to manage repayments. Amortization is a way of spreading out the loan into monthly payments. Mintos lets you select loans based on:

- full amortization (paid off in monthly instalments)

- partial amortization (paid off in big instalments near the end of the loan period)

- interest-only

- bullet (all interest is paid at the end period).

When I choose loans, I want to know that the amount is being paid down on a regular monthly basis.

Time Remaining

I look for loans between 1 month and 18-month repayment time as it is best to get your money in an out as quick as possible. No one knows what will happen in 5 years, in 1 year, or tomorrow.

I wouldn’t personally want to have my money locked up in 3 or 5-year loans if there was a financial crisis in the world (just looked at what happened with Covid-19). I also avoid anything with an initial timer period of less than 1 month (unless it only has one month to go) as there is no payment history on the loan.

Payment History

Payment history falls into several categories, including Past Repayments, Payments on Time and Status

- Past Payments – The more the better. Past repayments show that the borrower is more likely to pay the loan. These show that borrower knows how to use the system, and has put money down to pay off the loan. When I was investing in P2P earlier on, a lot of my investments were in loans with a period less than 1 month with no payment history. Nearly all of these reached “default” status, encouraging me to update my strategy.

- Payments on Time – If you are expecting to receive a certain percentage return on these investments at certain time periods (to further reinvest this money), you need to choose loans that are paid on time. Loans that have multiple payments coming in late, can imply that the borrower is struggling to meet repayments, potentially jeopardizing future repayments.

- Status – As mentioned above, only invest in loans that are current. Filtering out loans that are “late” contravenes the other payment history rules.

Yield to Maturity

YTM is the percentage return to expect on your investment. The amount you select can vary depending on you. I set my amount to an arbitrary number above 10%, however, I usually filter my results to show highest YTM at the top of the list.

Investment Amount

The amount you invest can vary depending on multiple factors not discussed in this article. I make sure that all of my investments are above “8” of whichever currency invested in. Above 8 means that you will see interest come into your account each month. As the yearly percentage return is split up into 12 separate months, any investments lower than 8 can risk receiving no interest return on some months.

Important Considerations When Manually Investing

Late Payment Fees

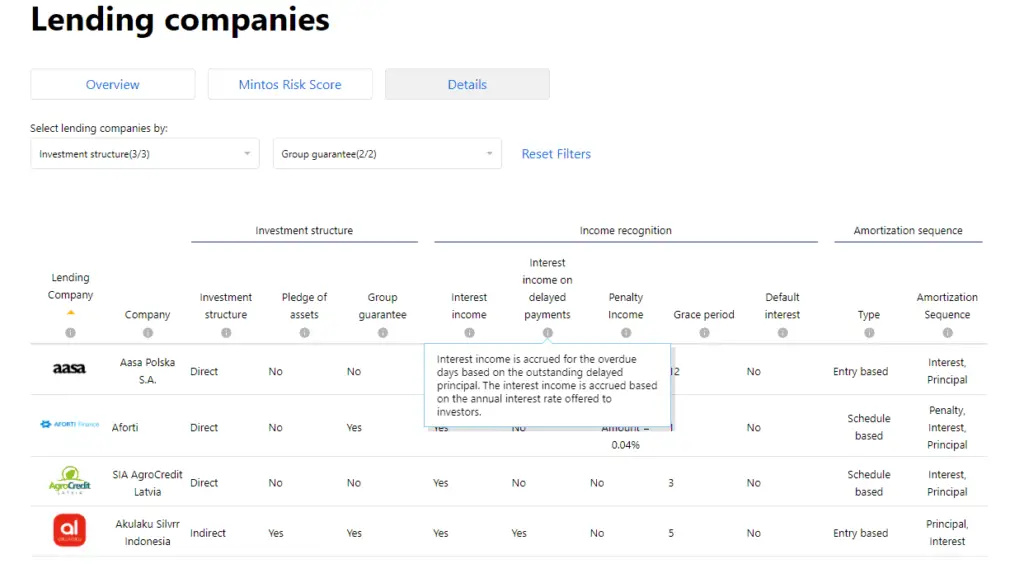

I mentioned “late payment” under loan history above. However, I thought it wise to elaborate a bit further. Not all lending companies pay interest on late payments. This is important to realise.

To find this information out, Investors must go through each of the lending company pages and find the items for “Interest income on delayed payments” and “Penalty Income”. There you will see if interest is paid out, and at what percentage.

Another important factor is that each lending company has a variable grace period. Seeing as the grace period is not counted as being late, there is no interest being accrued in this time. If the loan is not paid in that time, then the grace period counts towards the loan being late. Some lending companies have a grace period for up to 2 weeks.

Mintos Tax Implications

How does your country handle tax on your investments?

It could be wise for you to determine how your country taxes your returns as then you can structure your investments accordingly.

For example, if you have to pay tax on the interest gained alone, it would be good for you to select loans from the secondary market at a discount as the discount amount won’t get taxed. Similarly to cashback offers – If a lending company offers cash back if you invest in their loans, is this taxed in your country?

These are all questions that you need to ask yourself before determining how you re-invest your earnings.

Cross Boarder Lending – Money Exchange Cost

Investing in Georgian Lari (GEL), Russian Ruble (RUB) and Kazakhstani Tenge (KZT) may look inviting as you can earn in excess of 18%+, however, you must think how much it costs to invest in that currency.

Through Mintos you are able to convert into any of the currencies offered on the platform. Currencies are converted immediately, and the rate matches the mid-market rate provided through XE. Additionally, all fees are shown upfront and there is no mark-up on the exchange rate.

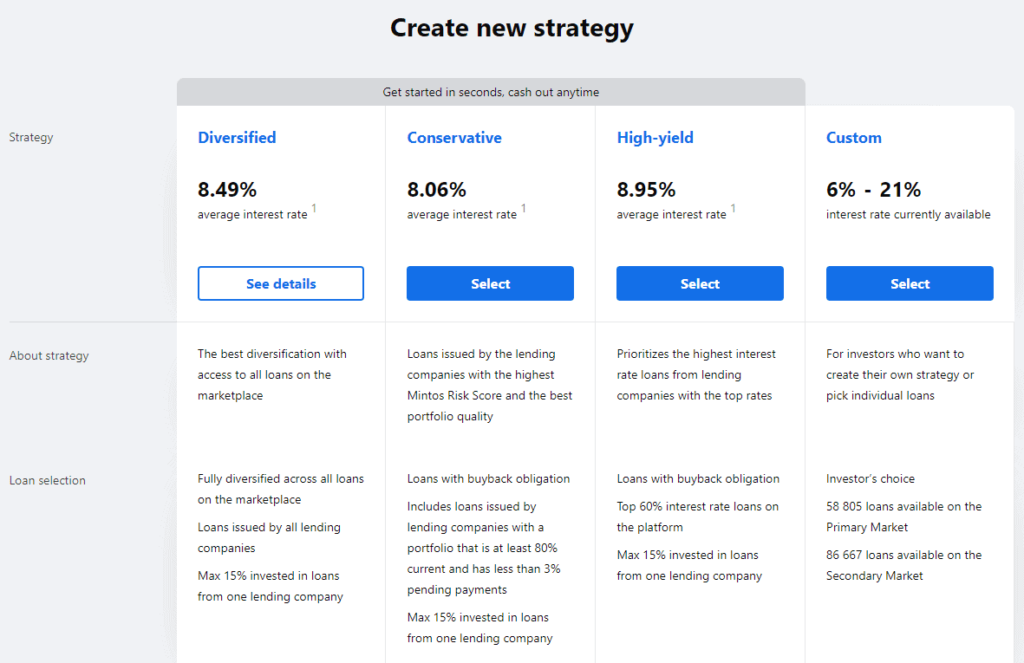

Mintos Automated Investment Strategies

As with other P2P investment platforms (Bondora, etc.), Mintos offers an automatic reinvestment tool, termed “auto-invest”. The reinvestment feature allows investors to set automatic investments according to set criteria. Investors can choose either one of the Mintos investment strategies (diversified, conservative, or high-yield), or use a custom strategy and choose their own settings.

We talk about the manual investing strategy above under “What Are Custom Manual Investments”.

If investors choose to use the Automated custom strategy, the tool allows investors to choose:

- Currency

- Market (primary or secondary)

- Lending company (based on country, buyback, loan type, rating etc)

- Interest rate

- Terms remaining

- Portfolio size

- Investment amount per single loan

- Diversification settings*

*The diversification feature will automatically set equal investment limits across each lending company included in the portfolio. You can read more on the Mintos website here.

Auto-investment features can be created, updated and deleted at any time. Investors are also able to browse and invest manually while running the auto investment strategy

Mintos Investment Strategies Review

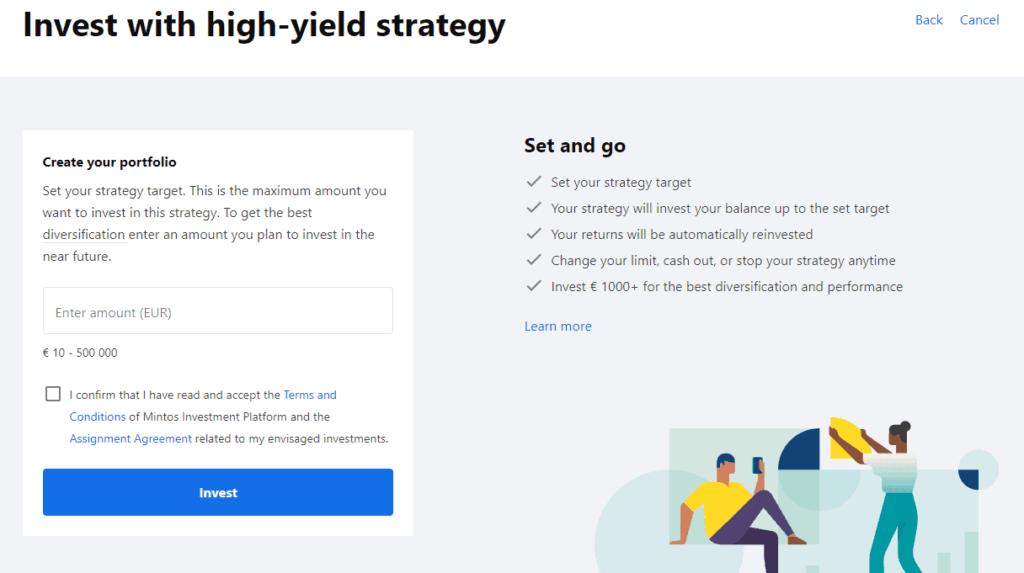

In June 2019 Mintos released their newest auto investment tool Invest & Access. The new tool allows you to invest in all loans on the Mintos platform and cash out your portfolio at any stage. After a while they changed this into “investment strategies” that were made up of portfolios based on certain criteria.

When your ready to sell, the platform will automatically (within a few minutes) sell your loans to other investors. If you have a loan that is “late” for payments, these will only be sold once they recover, or the buyback covers the amount.

If the Mintos marketplace experiences abnormal conditions (i.e. global recession), it may take longer to receive your money.

How Do Strategies Work?

The carious strategies are basically an automated reinvestment tool that selects loans based on certain criteria. For example, if you wanted to invest in the high-yield strategy, Mintos would automatically invest in

- the loans with the highest interest rates

- those that have buyback obligation available

- the top 60% interest rate loans

- a maximum of 15% in one lending company.

What is the benefit of Strategies

Oh, I forgot to mention the best part. You can cash out at any time!

There is no waiting for loans to be sold on the secondary market. You can just click sell. All loans that are currently up to date with payments will be automatically sold to other investors. If you have a loan that is “late” for payments, these will only be sold once they recover, or the buyback covers the amount. If the Mintos marketplace experiences abnormal conditions (i.e. global recession), it may take longer to receive your money.

Other benefits include:

- no fees (always good)

- an average return estimated at 8%+

- all loans have buyback obligations

- automatic reinvesting

- daily rebalance

- full diversification across most of the marketplace (i.e. 60+ lending companies from around the world)

Mintos Secondary Market

The Mintos secondary market is a place where investors can sell their investments to other investors.

The secondary market allows:

- increased liquidity, by allowing investors to sell out of a loan before the loan period is up

- increased revenues, by allowing investors to sell loans at a premium to their original value

- potential investors more options for purchasing loans

- potential investors to buy secondary loans at a discount to their original value.

The secondary market is very active with investments sold in 2018 totalling over €4,500,000.

The Mintos Team

The individuals that make up the Mintos team can be found here. Here are the two noteworthy individuals:

- Martins Sulte – CEO & Co-Founder

- Martins Valters – COO, CFO & Co-Founder

Mintos Pro Investors

Mintos offers investors the chance to become Pro-Investors. A pro-investor is someone who has an investment portfolio with a minimum of €50,000 or equivalent. The benefits of being a pro investor include:

- A personal investment account manager, tasked to help you with your needs or questions.

- Limited Edition offers, such as early access to new features (i.e. Auto Invest on the Secondary Market)

- Custom made investment reports

- Top priority customer support.

Mintos Alternatives

Mintos currently offers an overwhelming amount of choice in selecting the types of loans that you want to invest in. If your looking at manually investing, this could become very overwhelming.

That’s why we have listed a few alternatives for you. These are platforms that have a smaller investment base and provide more varied loans.

Alternative 1: Bondora

Bondora is an Estonian P2P lending platform founded in 2009. The platform only allows investments in Euros, and focuses on unsecured consumer lending throughout Finland, Spain and Estonia. The platform has over 128,000 investors from 85 different countries and boasts historical annual returns between 9.5% – 17.5%. My Bondora review can be found here.

Alternative 2: Reinvest24

Reinvest24 is a bit different to Bondora and Mintos. Reinvest24 provides fractional real estate investments in residential and commercial properties. The platform is relatively new (2018), but has managed to thrive and survive throughout the Covid Pandemic (when a lot of other platforms failed). Loans are protected through various collateral including the real estate itself. The platform currently has a total combined return (yield + capital) of 14.8%. My Reinvest24 review can be found here.

Depositing Funds into the Mintos Alternatives

The above Mintos alternatives will require you to either deposit money in Euros or have a bank account in the European Union / European Economic Area. If you don’t already have either of those things, you could look at Wise (formerly TransferWise) and Revolut. I currently use both of these as they work in different ways. This is what I have found:

- Wise is the cheapest option when bringing money from outside the EU into the EU.

- Revolut is cheapest option when transferring money within the EU (free transfers, Wise has small fees per transaction).

Both Wise and Revolut provides a currency account, which allows you to freely obtain European bank account details and a personal European IBAN. You can read more about Wise here.

You can find more alternatives to Mintos (or any other P2P platform) by looking:

- at our comparison of the best P2P lending platforms across Europe

- through our other platform reviews

- at my monthly portfolio. Here you can see how the funds actually perform in a portfolio.

Mintos Refer A Friend Referral Program

Mintos occasionally runs campaigns for their “Refer a Friend” referral program, which offers €50 for each new investor that invests more than €1000 into Mintos using your referral code. The 50 bonus will be applied to both the new investor, as well as the referring investor.

Additionally the investor will referred investor will also get an additional 1% bonus on the average investment in the first 90 days of opening their account.

If you are interested in signing up to this, drop your email in my contact form and I can sort out a referral link for you!

Mintos Review

I have been investing with Mintos now for the last 5 years. I have seen the platform double in both amounts of registered investors and also the number of loans available. I have had no real issues with the platform, and feel safe knowing that Mintos is the biggest P2P platform in Europe. I also feel safe knowing that both Martins Sulte and Martins Valters are open for communication, and regularly encourage investors reach out to them through virtual meetings. For someone new to investing in P2P, Mintos could be the perfect beginner platform.

Do you use Mintos?

Anything that you like or dislike? Let me know in the comments below…

Please note: Before investing in anything do your own due diligence and research. Nothing in this article is financial advice. Just one man trying to share his working and investing experiences!

Their system is not safe. My account has been hackered and they refused to take responsabilities

Hi Stefano! I really hope that isn’t the case! I know they have two factor authentication that everyone should have turned on!