Warning For Grupeer Investors

I no longer invest in Grupeer as there are currently too many problems with the platform. These include changes to Grupeers team, blocking of Grupeers bank accounts, and the potential for fraudulent Loan Originators, among other things. Withdrawal payments have been blocked since March 2020.

There is currently legal action underway. More about that here.

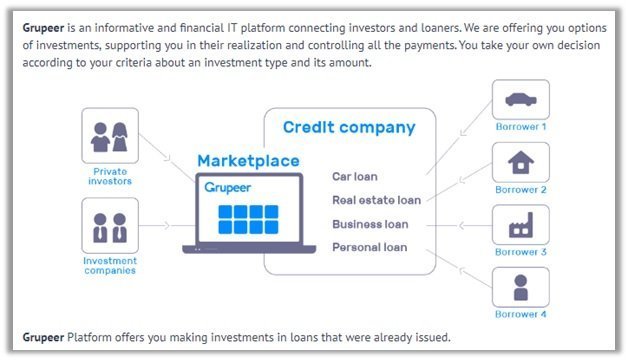

A P2P investment account is classed as an alternative investment (compared to things such as share trading, term deposits etc). What is P2P investing? P2P means peer-to-peer (i.e. from me to you) and allows one a person to take a loan from another person. This allows borrowers to bypass a bank or other official financial institution. The result – better loan interest rates for the borrower, and a higher investment interest rate return for the investor. These returns can be much higher than interest, term deposits and other financial investments. Grupeer currently offers up to 15% return on P2P investments!

About Grupeer

Grupeer (www.grupeer.com) is a Latvian P2P platform, created in 2016. Grupeer works in a similar way to Mintos, whereby acting as a platform that allows loan originators to issue loans. Currently, Grupeer only accepts money transfer from licensed credit institutions of the European Economic Area, and only deals in Euros. Loans issued on Grupeer focus on investments in credit deals (i.e. secured loans issued to individuals or small businesses), and development projects.

Grupeer Statistics

- Grupeer SIA, the limited responsibility company was registered in Latvia in November 2016.

- The Grupeer investment base has over 25,000 investors from 92 different countries.

- The yearly average return to investors stands at 13.19%.

- Over €81 million has been issued on the platform.

My Returns through Grupeer

I have been investing in Grupeer since July 2018, without any problems. See my graphs below to see what returns I have been achieving! These charts are automatically updated each month.

[visualizer id=”36026″]

[visualizer id=”36034″]

Grupeer Account Set Up

Creating a Grupeer account is easy, as shown in my article: How to create a Grupeer account.

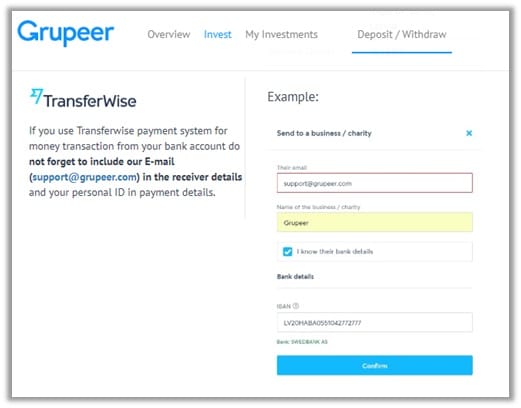

To send money to your Grupeer account, you need to find your personal id number under the “Deposit/Withdraw” tab. On that page you will find the banking details of Grupeer SIA to which you can make payments. When making payments, it is important to include your payment ID in the details of the payment, otherwise the money will be returned to your account.

Money can be sent from your TransferWise account (as seen in the picture below), however, a withdrawal cannot be made from the Grupeer platform to your TransferWise account. Grupeer save the details of the account that money is received from to verify who to return money to once you decide to make a withdrawal. Unfortunately, TransferWise do not send the money from your TransferWise specific European bank account. Money will be sent from a group TransferWise account and Grupeer will not return money to that account. However, to get around the TransferWise problem, investors can open another European account through a digital bank platform such as Revolut. Revolut acts in a similar way to the borderless account that TransferWise offers, however, will send money using the specific European banking details (IBAN, Swift Code, Bank address etc) that they provide you with.

If you already live in the EU, and have an EU bank account, you can use those details and not have to worry about the above.

Note: In regards to Transferwise Grupeer have this comment:

Important announcement regarding TransferWise

Please be advised that we do not recommend making transfers via TransferWise. The payments via TransferWise are sent from its general account and therefore arrive to us as undefined. In case you send the funds via TransferWise the identification of your payment according to the AML policy requirements may result in a delay or refund. We strongly recommend you to fund your Grupeer posting account from a personal bank account using relevant banking details shown below.

Grupeer Buyback

Currently, all loans offered through Grupeer have a buyback guarantee associated with them. That means that the loaners that issue the loans to investors, are obliged to buy back loans if no payment has been made for 60 days. The buyback obligation is a result of the initial agreements between Grupeer and the credit companies issuing the loans.

Grupeer Collateral Loan Protection

Some loans on the Grupeer platform are covered under a “Collateral Loan Protection”. Collateral loan protection applies to loans that are fully covered by property or other assets that a borrower offers to secure the loan. Loans with an umbrella icon next to their name are covered under the protection.

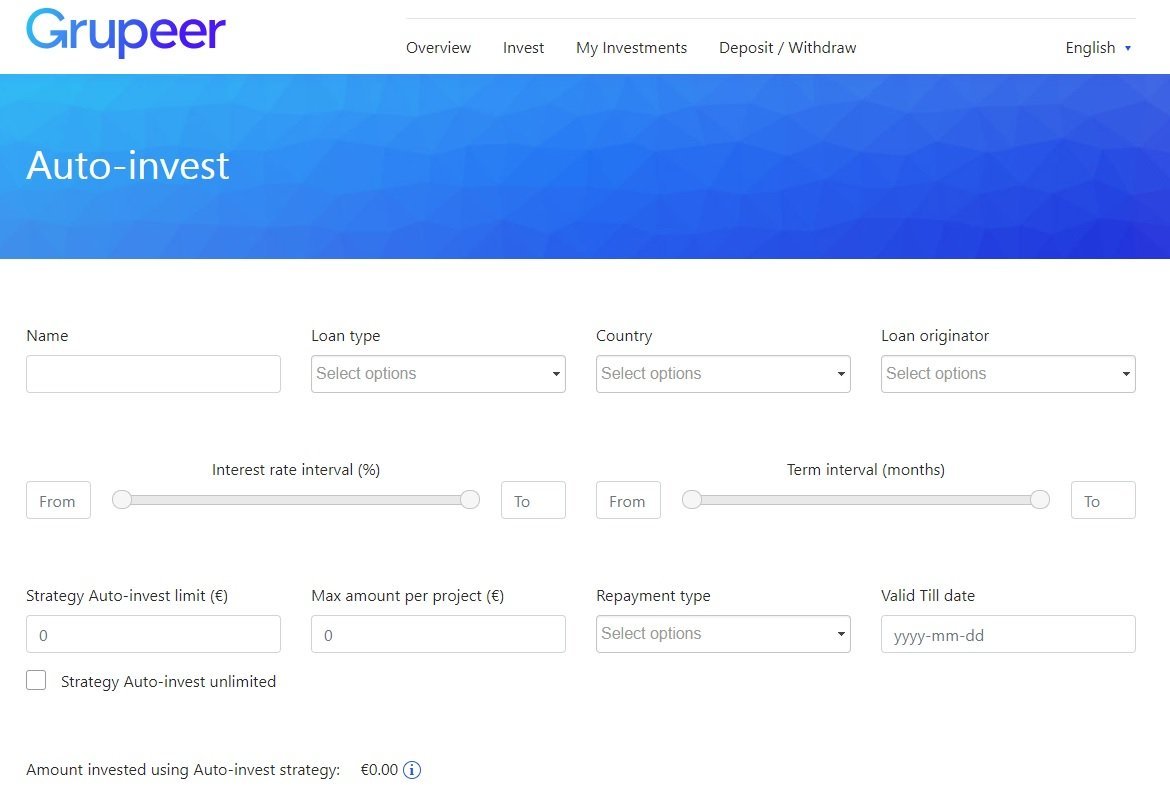

Grupeer Auto Invest

As with other P2P platforms (Bondora, Mintos etc.), Grupeer offers an automatic reinvestment tool, termed “auto-invest”. The reinvestment feature allows investors to set automatic investments according to set criteria. The auto-invest feature allows investors to choose:

- loan type (Mortgage, Car, Business, Personal, Development Project)

- country

- loan originator

- interest rate interval (%)

- investment term interval (investment time in months)

- strategy auto-invest limit

- max amount per project

- repayment type (amortization)

- expiry date of the reinvestment strategy.

Grupeer investors can only create up to 10 reinvestment strategies. Grupeer also includes an Auto-invest manual to answer helpful questions that may arise from the Auto-Invest tool

The external FAQ available on Grupeer currently does not include information about the auto-invest feature.

Grupeer Secondary Market

On the Grupeer platform, there is an option for “Secondary Market” under the Invest tab, however, this feature does not seem to have commenced yet.

The secondary market on Grupeer will most likely reflect those on other platforms such as Bondora and Mintos.

Grupeer Cashback

The Grupeer P2P platform has a bonus program referred to as Grupeer cashback. What it means, is that if you invest in a P2P loan that has the cashback deal applied, you will receive that value back into your account. Cashback offers usually have set conditions, including a specific time frame that the offer is open. As per the FAQ on Grupeer – cashback is calculated from the amount of the deal. Cashback offers are usually set at 1%.

Investment risks

The investment risks of making investments through Grupeer are similar to all of the other P2P platforms. Unfortunately with the recent problems at Grupeer, those risks have materalised. You can find more information about P2P investment risks in P2P investing.

Grupeer Review

I invested in Grupeer for a nearly 3 years now. It honestly came as a surprise that there would be so many issues that have come out over the last few months. As stated my immediate notice at the top, you can not currently withdraw any money from the Grupeer account.Therefore, I would encourage you to think extremely carefully about the risks of investing in this p2p platform (if you even can at the moment). It will be very interesting to see whether the platform can survive.

To stay abreast of the most recent news, including progress reports, follow the Grupeer blog here. To find out more about legal action, check out the Grupeer Armarda here.

Please note: Before investing in anything do your own due diligence and research. Nothing in this article is financial advice. Just one man trying to share his working and investing experiences!