Warning For Fast Invest Investors

I no longer add more money into Fast Invest. I, like many other investors have been waiting since late April for withdrawals to be processed. Until these have been processed, I can not add any more money into, or invest in any new loans on the platform. Additionally there have been concerns from others, which has created a group who aim to ensure withdrawals are processed and agreements are honored.

What Is Fast Invest?

Fast Invest is a Peer-2-Peer (P2P) investment account, which is classed as an alternative investment (compared to things such as share trading, term deposits etc). What is P2P investing you ask? P2P means peer to peer (i.e. from me to you) and allows one a person to take a loan from another person. This means that you bypass a bank or other official financial institution. The result – better loan interest rates for the borrower, and a higher investment interest rate return for the investor. These returns can be much higher than interest, term deposits and other financial investments. Fast Invest currently offers up to 16% return on various P2P investments!

About Fast Invest

Fast Invest (www.fastinvest.com) is a United Kingdom P2P platform created in 2012. They have offices in the UK and Lithuania. The platform offers consumer loans in Spain, Denmark and Poland. The platform offers investments in two currencies: European Euro (EUR) and Polish Zloty (PLN). All loans have a maximum timeframe of 12 months. Fast Invest offers loans with BuyBack and MoneyBack Guarantees. The MoneyBack guarantee allows the investor to sell their loan back to Fast Invest, before the investment period is up (but you will lose the interest). The BuyBack Guarantee will settle any arrears if payments become more than 3 days late. The minimum investment amount is only €1.

Investment Eligibility

Investors must be over 18, with an EU IBAN account. Such accounts can be gained through TransferWise (find more about TransferWise here) or Revolut if you are outside the European Union. Investors must be from one of the 55 supported countries (which can be found in the FAQ section of their website).

Statistics

Fast Invest is a private limited company, registered in the United Kingdom in December 2012.

- Paid out interest: € 800,000

- Average Interest Rate: 12.4%

- Registered investors: 33,000+

- Total funds invested: € 26,000,000+

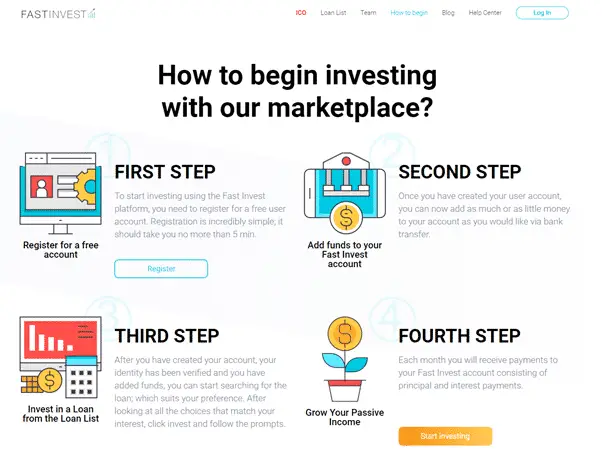

Fast Invest Account Setup

You can become an investor with the platform quite simply. Just fill out investor registration, add funds, choose loans to invest in, and wait for the loan repayments to be made.

In order to withdraw funds from your account, you need to confirm your identity and have a personal bank account in your name in the European Union.

Platform Use

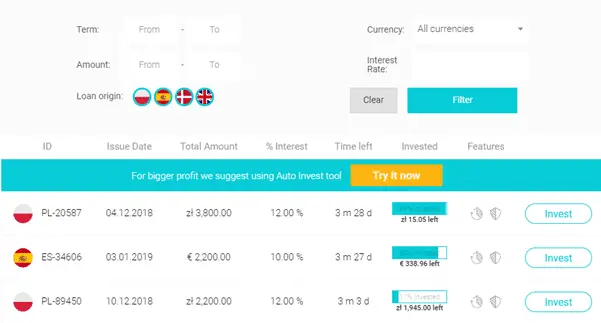

The Platform is straightforward to use, and loans are easy to select. You can filter loans by term, amount, loan origin (Poland, Denmark, Spain), currency and interest rate.

What Types of Loans Are Available through Fast Invest

Fast Invest currently offers consumer-based loans across the European Union. The platform supports 2 currencies – European Euro (EUR) and Polish Zloty (PLN).

All loans are 100% pre-funded by the Loan Originator, and the Loan Originator will always keep at least 5% skin in the game

MoneyBack Guarantee

If you choose to sell your investment before the due date, Fast Invest will purchase the loan back within 1 business day guaranteed. Look for loans with this symbol:

If you choose to sell the investment before the borrower has completely paid it off, you will lose all interest earned through the process, but you will receive all of your initial investment back.

Defaults / Buyback Guarantee

Fast Invest will offset the payment, and if the payment is overdue by more than 3 days, the Fast Invest buyback guarantee will commence. Look for loans with this symbol:

The investor will gain funds from the principal sum and the investment period.

Fast Invest Fees

Opening an Investment Account | Free |

Account and Administration Fees | Free |

Service Fee | 0% |

Loan Sale via Money Back | 0% |

Withdrawal to bank account | Free (external bank commissions may apply) |

Identity verification | Free |

Adding a bank account | Free (external bank commissions may apply) |

Auto Invest

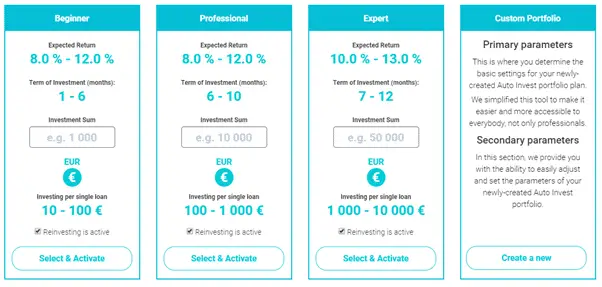

Fast Invest provides 3 levels of recommended auto investment portfolios based on beginner, professional and expert level. If you are not comfortable with the choices provided, they also offer investors a chance to create their own custom portfolio.

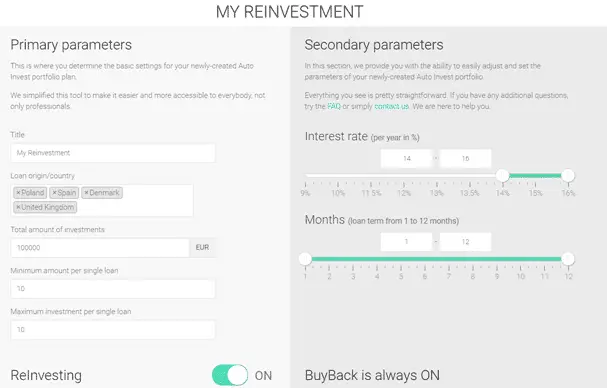

When creating a custom portfolio, investors can select:

- Loan origin/country (Poland, Spain, Denmark)

- Total amount of investment

- Minimum and maximum per single loan

- Interest rate per year

- Duration (1-12 months)

- Reinvestment

Fast Invest Blog

Fast Invest has a comprehensive blog which can be found at https://www.fastinvest.com/en/blog. Past topics include new features and products, cashback opportunities, general financial information, ways for investors to earn more.

Fast Invest Review

Fast Invest was a great investment platform in the P2P space, however a couple of months back everything started to turn. The website has now changed, decreasing transparency in the platform, they have used lawyers to silence bloggers, and the majority of interactions on the website seek more funds. This includes popup boxes when you are try to withdraw funds, the online chat bot reminding you to invest, big flashing banners, and the majority of the copy on their new website.

Finally, the withdrawals are taking more than 3 months to process. Why are they taking this long? If you cancel the withdrawal, that money can be used and reinvested into other funds.

So if it exists, why can’t it be withdrawn? Unfortunately, for these reasons, I am not investing any more funds in Fast Invest in the near future.

Additionally there have been concerns from others, which has created a group who aim to ensure withdrawals are processed and agreements are honored.