Hello Everyone! Welcome to my (May and) June update, where I will discuss my returns for the last two months

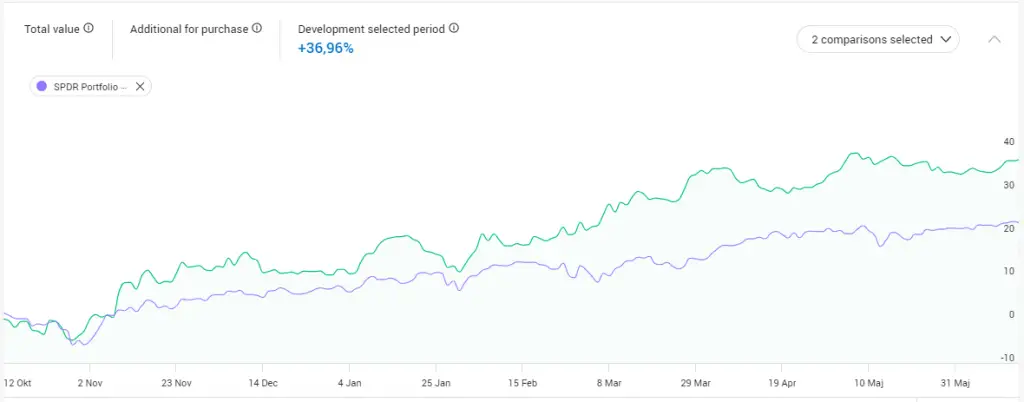

- since inception (Oct 2020) my international share portfolio has returned 36.96% against the SPDR S&P 500 ETF which returned 22.67%

- my P2P and Crowdlending investment profile returned an average of 0.10% and 0.43%, bringing my total for crowdlending to a return of 1.94% for 2021.

- my Solar panel system generated 63.371 kWh of energy in April and 46.946 kWh of energy in May (paid out in BTC), bringing my total energy production to 990 kWh. Total carbon saved – 1019.58 kg

- my total investment portfolio increased close to 10% from previous two months

Quick Summary

The main items that happened throughout the previous months include:

- Removed tracking of Grupeer, Bondora, Plenti and Fast Invest

- Added Buys and Sells for my Investment Account

- Updated My Portfolio page with new dividend information

- New cryptocurrency – AMP – through CoinbaseEarn

Monthly Message

Hey Everyone, Sorry that I missed the update for last month. I have been fairly busy lately with all the Covid things, and also the various jobs that pop up as we come into Summer. I will try and make this (and future ones) a bit shorter and more succinct. I may also experiment with posting these updates on a quarterly basis, instead of each month (but I will still aim for monthly emails). This is for a couple of reasons – (1) the majority of my investments are in the stock market, and these don’t change all that much. and (2) I will have more time to provide actual proper articles. The graphs in my portfolio will be updated more frequently than quarterly.

Thanks for sticking with me!

Overall Asset Allocation

Here is how the allocations of funds in my investment portfolio is currently looking. I decided to show you the percentage change over time to provide some more context. Other includes platforms such as AxiaFunder and The Sun Exchange.

[visualizer id=”37724″ lazy=”no” class=””]

Shares Breakdown

Here is the breakdown of my current share holdings (in just one of my accounts – my Avanza Kapitalförsäkring Account.

My strategy with this account is to focus on Dividend Growth Investing, with an aim of receiving a yield on cost of 10%+ after 10 years.

[visualizer id=”37081″ lazy=”no” class=””]

Crowdlending Breakdown

Here is my current crowdlending allocation. I am happy with only these three platforms, and I will likely not be adding additional platforms at this time. as crowdlending has performed extremely due to COVID.

[visualizer id=”35423″ lazy=”no” class=””]

I have now removed my tracking of Fast Invest, Grupeer, Bondora and Plenti. These have been for various reasons, which I will discuss once more further down the page.

Progress Towards Financial Freedom

[visualizer id=”37500″ lazy=”no” class=””]

The above graph is my investment portfolio that shows my progress towards a set goal for financial freedom.

The last few months my account has rocketed 2% closer to reaching my 20 year goal of financial freedom. This was solely due to a large bump in one of my share trading accounts.

I’m currently 6% higher than my guideline, so hopefully I can reach my goal with many years to spare. However, I do understand that markets are going crazy at the moment, and that value of my shares can easily drop 20%-30%. I actually look forward to that day, as it means that I can deploy some of the cash that is stored up. I am in it for the long haul, so I’m not worried.

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Share Portfolio

Since mid-October 2021 I have gained 36.96% in my Swedish kapitalförsäkring account. This has outperformed the SPDR S&P 500 ETF by a fair margin (14%). My goal is to be able to match the fund, while also being able to generate passive income through dividend growth investing..

Note: my portfolio is not solely based on dividend companies. I do have other growth stocks that don’t pay dividends, however these are in other currencies and exchanges, and not a part of my kapitalförsäkring account shown below.

If you are interested to see the breakdown of the investments, please see the chart below.

[visualizer id=”37081″ lazy=”no” class=””]

Buys and Sells

In April and May I made the following transactions. I am soon adding more information in my portfolio page, where you will be able to find more detailed descriptions, my 10in10 criteria, and the various abbreviations on my Share Trading Page.

Share | Buy/Sell | Reason |

|---|---|---|

ENB.TO | Buy | 7%+ dividend with 5%-7% growth over the next 3 years |

AQN.TO | Buy | 4%+ dividend with a dividend CAGR of 10% for the last 10 years |

MRK | Buy | Good Dividend ~3.5% and growth rate. Additional shares for OGN from spinoff. |

OGN | Acquired | Acquired as a result of the MRK spinoff. |

T | Sell | Dividend to be cut due to company selling streaming services. Falls out of 10in10 criteria. |

Dividends

Dividends received over the last two months include:

ABBV, ENB.TO, CVS, T, CSCO, & MSM

P2P and Crowdlending

The last few months saw an absolute dismal return in my p2p and crowdlending portfolio. Over these months combined, I received an average return of 0.52%. If you extend that out for the year, my total return would be looking at 3.12%. Thats definitely not good enough.

The main issue for me is that I am heavy in Crowdestor, and the majority of loans on their platform are delayed. Luckily I only have a very small percentage of my overall wealth in these.

As these returns are extremely poor, and I am aiming higher than a 3.12% return each year, I plan on leaving / reducing my exposure to the crowdlending sector.

[visualizer id=”37515″ lazy=”no” class=””]

To see the actual graphs for each of these platforms, head on over to my portfolio page.

Removed Tracking

I have now removed tracking from the P2P / Crowdlending platforms Grupeer, Bondora, Plenti and Fast Invest.

There is nothing wrong with Plenti or Bondora. I am currently withdrawing out of these platforms as I am extremely cautious of investing in loans for people during the pandemic. Bondora has been around for a long time, and Plenti is listed on the ASX (Australian Stock Exchange).

On the other hand, I have basically written off (not included in my investment portfolio graph) the Grupeer portfolio. There is no communication from the platform and there is no way to get back any of the money investors currently have invested.

I am also getting out of my small position in Fast Invest as fast as possible. One of the main reasons that I am getting out of this platform is that I don’t feel as though my money is safly invested. When trying to withdraw the “uninvested money” on my account, Fast Invest places a restriction what can be be withdrawn (i.e. <10% of available money per request). They also take months to process any of the payments, with the timer being reset each time you make a withdrawal. That is not normal.

The Sun Exchange – Passive Income from the Sun

The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform (if you use the affiliate link, then you will receive 1 free solar cell on your first purchase!). If you are interested in finding our more about the sun exchange, please check out my full platform review.

[visualizer id=”36117″ lazy=”no” class=””]

The last couple of months my cells were able to generate 63.371 kWh and 46.946 kWh of energy (paid out in BTC). These months are a bit lower in energy generation as its now coming into the middle of winter in South Africa.

My total energy generated through The Sun Exchange is currently at 990 kWh, which would allow me to drive 3,675 American miles in a Tesla Model 3 (just need to buy one first).

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 158,400 slices of bread.

AxiaFunder

Recently I invested in litigation funding through AxiaFunder. This is external to other platforms, as the income is not controlled by borrowers ability to pay a loan on time, the currency exchange rate, the markets, or other global health pandemics.

AxiaFunder connects investors with carefully pre-vetted commercial litigation opportunities. The platform invests in legal cases where there is a high probability of winning at court, with potential returns of 20%-30% pa. The only downside with litigation funding – returns are not guaranteed, there is a risk of loosing all of the investment if the case fails, and in some very extreme circumstances, could have to pay more than the amount you put in. (every case is insured, but if the insurance company was to default, then the investors would need to fund more of the project).

Projects are few and far between, and usually last for long periods of time >12 months.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin. If you want to see what this is about, I encourage you to find out more through my main article – My Journey to One Free Bitcoin

Coinbase Earn

I was able to get my hands on approx 30 AMP this month through Coinbase Earn. AMP is an Ethereum token that aims to “collateralize payments on the Flexa Network. I did see there were some other tokens on offer, but they were not currently available for me.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From there you earn various cryptocurrencies as a reward. I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Money Savings

With so much work, and not a lot of time to be on Twitter, so there haven’t any original tweets in a while now!

Progress on Internal Changes

In a past update, I made a pledge to update sections of my blog. I will keep this section here until these tasks are fully complete. The remaining tasks are:

- (Priority #1) Adding a page outlining some basic steps for how due diligence can be performed. (started writing this)

- (Priority #2) Adding a section to each platform review with my own due diligence.

- (Priority #3) Placing stronger disclaimers within each platform review page saying how my interests lie within the article.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) .

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.