Hello Everyone! Welcome to my May update where I will discuss my returns for April 2020.

Again another late update. I am sorry! The roller coaster continues! This month, my P2P and Crowdfunding investment profile returned an average of 0.21%, bringing my total for crowdlending to a return of 3.93% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). However, my total value increased 10% from last month (mainly due to the swings in the stock market). The highest of my crowdlending returns came from:

- Bondora (+1.24%)

- Mintos (+0.88%)

- Fast Invest (+0.87%).

Quick Summary

The main items that happened throughout April include:

- Continued Coronavirus effects

- Half of the P2P platforms have paused payouts

- Purchases of more shares

- Featured in Zero to Freedom’s Article: What Investors Wish They Knew Before Starting Out

Kuetzal and Envestio Progress

This money there is news of bankruptcy proceedings with Kuetzal.

Notice of the time and place of the examination of the bankruptcy petition and notification of the prohibition on disposal

By court ruling of 8.04.2020 in civil case no. 2-20-2366, the bankruptcy petition filed against the debtor, KUETZAL OÜ (registry code: 14519131) was accepted for processing and a court session was scheduled for review of the bankruptcy petition.

The court session will take place on 27.05.2020 at 10:00 in hall no. 2021 of the Tallinn Courthouse of Harju County Court

https://www.teatmik.ee/en/personlegal/14519131-Kuetzal-O%C3%9C

I will fill in any more details as they come to light.

As with Envestio There is no progress. See past updates if you are unsure what has happened

What should I do if I lost money with either Envestio or Kuetzal?

If you placed your money with Envestio, download and fill in the crime report form and email it to us at [email protected]. You will receive an automatic reply and we will ask you to fill out the form attached and enclose any documents in your possession relating to Envestio SI OÜ, proving that you have suffered damage. You can ignore the automated e-mail if you have already complied with the requirements set out in the letter.

If you placed your money with Kuetzal, e-mail us at [email protected]. If we need any additional information, we will contact you.

Estonian Police and Boarder Guard

Progress on Internal Changes

In a recent update, I made a pledge to update sections of my blog based on the issues with Kuetzal and Envestio. I will keep this section here until these tasks are fully complete. I have been slow on these as I have not spent much time on the blog:

Showing my overall asset allocation.Reducing my crowdlending portfolio from 12 platforms to 7.- Placing stronger disclaimers within each platform review page saying how my interests lie within the article, including showing my investment graphs and overall asset allocation.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) . - Adding a section to each platform review with my own due diligence.

- Adding a page outlining some basic steps for how due diligence can be performed.

Overall Asset Allocation

As I want to provide more information to everyone who comes and visits my page, I will now show how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″]

[visualizer id=”35423″]

This month my allocations have changed a fair bit, but this is due to the negative returns of my share portfolio. I now have approx 73.3% in shares, 10.3% in cash and 16.3% in crowdfunding.

Overall it’s a net gain this month of 10% of my total portfolio (due to that pesky Coronavirus). Its nice to see that I am back over 10% towards Financial Freedom!

Progress Towards Financial Freedom

[visualizer id=”36059″]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

This section is still very new and was only included near the start of the year. I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages. As I am also planning to reach my goal (i.e. 100%) within 20 years, I have laid down a guiding path based on my expected returns and estimates. I have set a very conservative estimate of 20 years to become financially independent, as I am currently aggressively paying off the house, and raising a (very) young family.

Once the mortgage is paid off in 8 years, I expect to really hit the accelerator on my investments. This graph will change regularly with new information and calculations etc. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Why are we focusing on the mortgage rather than FI? That’s another article for another day!

P2P and Crowdlending

P2P Platforms in possible trouble

Monethera

Since the newsletter (23rd March), there has been no communication from Monethera, with the suspicion that they may not return. As per my earlier updates, I decided to get out of Monethera as I deemed it too risky, and I was unable to do any proper due diligence on the platform.

Grupeer

Recently Grupeer has released a few articles: Grupeer predicts stabilization within two years and Grupeer crisis overcome plan. Both of these articles talk about future plans of the platform. Additionally, Grupeer has also updated their FAQ sections to address some of the concerns raised by investors:

- Why are Grupeer’s accounts frozen?

- How many of your loan originators are “bad debtors”?

- Why do some of the loan originators (like Northcon Norge, Dziesiatka Finance), whose projects you have on your platform, have denied cooperation with Grupeer?

- o you check your loan originators after you have entered into agreement with them?

Grupeer are currently carrying out a portfolio performance audit, and we will share this update in June. All payments from the platform have been suspended to investors.

Some investors are unhappy with the platform and have already initiated a lawsuit. More can be found through various Telegram and Facebook groups.

My Returns in Crowdlending this month

This month saw my P2P and Crowdfunding profile return on average 0.21% This is the lowest return I have ever received, and likely the lowest for a while.

[visualizer id=”36017″]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in April):

- Crowdestor has let investors vote on how to progress on receiving payments from current loans during COVID-19

- Additional funding rounds for Crowdestor Equity campaign released

- Bondora‘s competition to win a BMW 330i finishes, and is drawn at the start of June.

- Monethera is still likely gone, similar to Envestio and Kuetzal.

- Projects through The Sun Exchange are continuing construction with COVID restrictions being lifted in South Africa.

Didn’t I Have More Platforms?

Yes. But after the collapse of Kuetzal and Envestio, I decided to move away from the “diversified experimental phase” and re-align my crowdlending portfolio with platforms that I am happy with. As part of the change, I have reduced my initial 12 platforms to just 7. Apart from Kuetzal and Envestio, the additional 3 platforms that I stopped investing in, and withdrew my money was from were Monethera, Wisefund, and Crowd Estate. Read my earlier update for the reasons I exited those platforms. I seem to have been quite lucky in getting out of Monethera in time.

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

0.88% | 28.87% | 2.5 years | |

1.24% | 35.71% | >1.5 years | |

Grupeer | 0.00% | 23.53% | >1.5 years |

RateSetter (AU) | 0.67% | 40.09 | >4.75 years |

0.87% | 17.52% | 1.5 years | |

0.00% | 14.71% | >1 year | |

0.31% | 3.15% | <1 year |

Mintos

Mintos, a.k.a. “old faithful” keeps plodding along doing its thing. Less interest this month for obvious reasons. Mintos survived the market crash of 2008, so I am pretty happy with my money in there at the moment. They seem to be paying out as expected through the COVID crisis.

Bondora

Bondora is another one that I have been invested in now for nearly 3 years. The returns that I got this month were consistent with my other returns for this year.

I have started to handpick each loan through the secondary market, but this is time-consuming and there are no buyback guarantees!. This way I am taking an active approach in picking quality loans (high rate of return, confirmed borrower, high credit score, payments on time, etc.). I am hoping that this will be more rewarding that automatically investing.

Grupeer

Grupeer is another that is coming up to its 3rd birthday in my portfolio this year, which is why its sad to hear the news that it may have issues (see above).

RateSetter (Australia)

Rate Setter in Australia was the first P2P platform I invested in. I have recently put my money back to work, which can be seen in the higher returns in April (compared to March). The downside is that it’s earning much less than the other European platforms.

Fast Invest

Fast Invest keeps producing consistent returns, which is good to see. There are many investors that are spooked by the other platforms shutting down, and have also withdrawn their money from Fast Invest. This may be because their loan originators remain a mystery, and can’t be verified. Additionally it takes up to 2 weeks to get your money withdrawn from the platform. However, the platform has started to offer remuneration for over-pending payouts (aka. interest while you wait for the withdrawal)

Due to all of the withdrawals, Fast Invest has bumped up their returns to a max of 18%.

Crowdestor

Crowdestor is still my favorite P2P platform to invest in at the moment. There is just so much to like!! This month did not produce any returns, but that is because of the COVID crisis. This month I did reinvest some of my earnings into:

- WarHunt Movie – editing has started & negotiations with streaming companies (5 months, 24% p.a.)

I have also been extremely happy with the high level of communication between Janis Timma (the CEO of Crowdestor) and the investors. We get a lot of information about all of the projects and the current scenario at Crowdestor. The investors were also involved in making a decision on the way forward with obtaining payments from the borrowers.

This month Crowdestor also ran their third tier of their equity campaign. This campaign will fund platform expansion, and will allow investors to take part in the success of Crowdestor.

Since I have started investing with Crowdestor, I have earnt on average over 1% p/month. Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

For now, I am happy to keep plodding along with Reinvest24. The apartment has still not sold yet :(. If the apartment is sold soon, then I will happily invest into the newer properties on offer!

The Sun Exchange

A few months ago, I purchased some solar cells from The Sun Exchange (if you use the affiliate link, then you will get a bonus solar cell on your first purchase!). The Sun Exchange is the world’s peer-to-peer solar cell micro-leasing platform.

The platform works by people purchasing solar cells, which are then leased to companies (such as schools, nursing homes, shopping malls etc), who will pay for the electricity that is generated by your cells. The companies generally can’t afford the outright cost of the systems themselves, which is where the crowdfunding aspect comes in. The solar system will be split up into many smaller cells, that are sold at a reasonable price. Solar cells can be bought in either BTC or the local currency. I will write a more detailed article about the platform in the future, so look out for that!

This month there was no new generation, as the system that I purchased cells has not been commissioned yet (due to COVID). That is happening this month, and my production should greatly increase from here!

My total generation is currently at 39 kWh, which is enough to fully charge an Nissan Leaf Electric Car!

In a new @TEDTalks @TEDxJoburg talk, @TheSunExchange CEO, Abe, discusses how individuals from across the globe can #solarpower the world and speed up the clean energy revolution! Spread the word, by liking & sharing this revolutionary message! Watch here: https://t.co/R50RV92t22

— The Sun Exchange (@TheSunExchange) March 20, 2020

Share Portfolio

A few months ago I set up an automatic share purchase system, where I automatically pick up 4 index funds, and one investment fund each month. This is a real set and forget strategy that works well to.

As they say, its not about timing the market, but instead, time in the market. Additionally in April, I picked up the Swedish Bank SEB.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have close to 150,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing! This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more. Each new player using the specific link receives 200 satoshi for free!

New updates in the game mean that you can now earn ETH and DOGE as well as BTC!

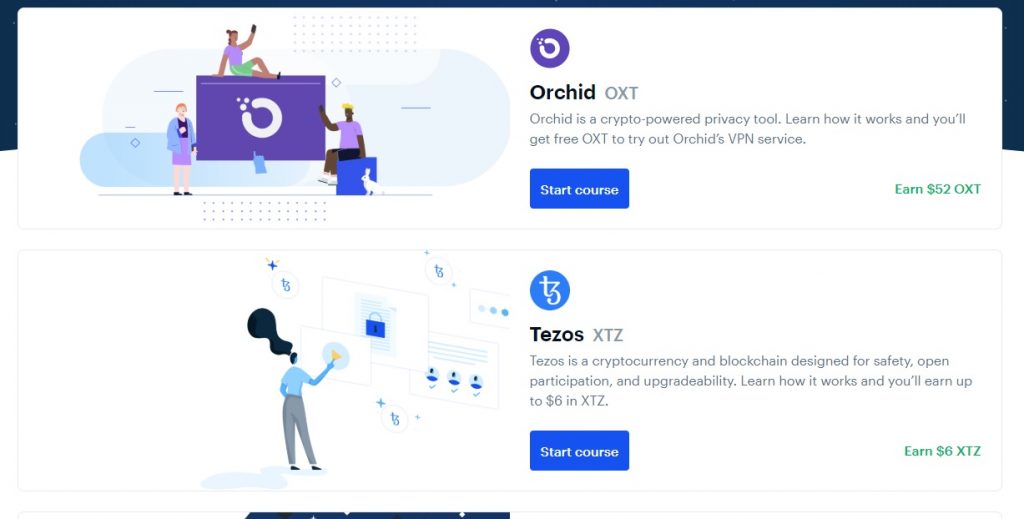

Coinbase Earn

Last month I found out that there are more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency. If you haven’t checked it out you should do that already! You can earn some coins simply by watching videos.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

In addition to our garden, the wife and I decided that it is now time to get chickens! We now have 4 cute Swedish Flower Chickens (2 hens, 2 roosters) that we will get eggs from daily! We plan to get more hens soon, with the roosters likely needing to be re-homed.

Here are some of my other adventures this month:

Picked up a free trampoline from Facebook Marketplace the other day.

— Matt | thewahman (@MattWAHman) April 27, 2020

Not one of those little exercise ones, but a proper full-size one with a safety net.

“Used” condition, but will provide seasons of fun ?

Why ever buy things new? ?#savings

I try and do one little #productive thing each day – something quick that only takes a couple of minutes.

— Matt | thewahman (@MattWAHman) April 20, 2020

Today was going around and tightening the handles of the cupboards in the bathroom.

That is now one less annoyance every morning ?

I try and do one little #productive thing each day – something quick that only takes a couple of minutes.

— Matt | thewahman (@MattWAHman) April 20, 2020

Today was going around and tightening the handles of the cupboards in the bathroom.

That is now one less annoyance every morning ?

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers are over 580

- My website sessions only slightly decreased, which is be expected, seeing as I haven’t been releasing so many articles!

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Better late than ever Matt. Great update, enjoyed reading it as usual 😀

Hi Tony!

I really appreciate you stopping by :). I am finding it really difficult to have time for the site these days!

Matt