Warning For Grupeer Investors

I no longer invest in Grupeer as there are currently too many problems with the platform. These include changes to Grupeers team, blocking of Grupeers bank accounts, and the potential for fraudulent Loan Originators, among other things. Withdrawal payments have been blocked since March 2020.

There is currently legal action underway. More about that here.

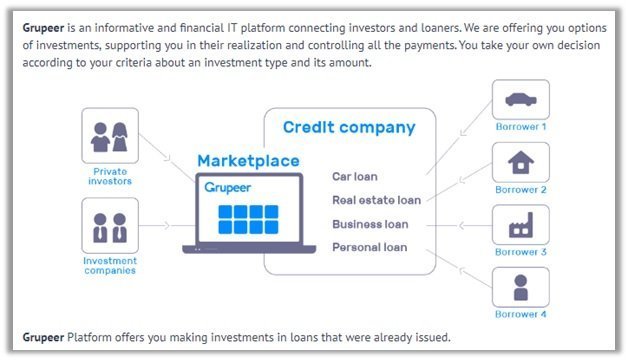

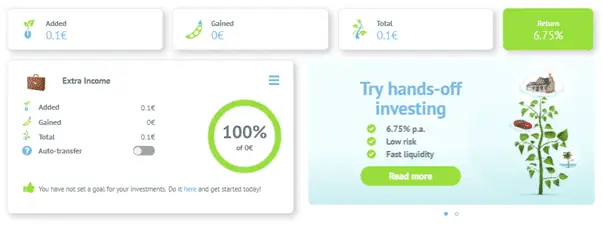

A P2P investment account is classed as an alternative investment (compared to things such as share trading, term deposits etc). What is P2P investing? P2P means peer-to-peer (i.e. from me to you) and allows one a person to take a loan from another person. This allows borrowers to bypass a bank or other official financial institution. The result – better loan interest rates for the borrower, and a higher investment interest rate return for the investor. These returns can be much higher than interest, term deposits and other financial investments. Grupeer currently offers up to 15% return on P2P investments!

About Grupeer

Grupeer (www.grupeer.com) is a Latvian P2P platform, created in 2016. Grupeer works in a similar way to Mintos, whereby acting as a platform that allows loan originators to issue loans. Currently, Grupeer only accepts money transfer from licensed credit institutions of the European Economic Area, and only deals in Euros. Loans issued on Grupeer focus on investments in credit deals (i.e. secured loans issued to individuals or small businesses), and development projects.